|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

FHA Streamline Refinance New Jersey: Important Considerations and OptionsUnderstanding FHA Streamline RefinanceThe FHA Streamline Refinance program is designed to help homeowners in New Jersey lower their mortgage payments with reduced paperwork and requirements. This refinancing option is particularly beneficial for those who currently have an FHA loan. Key Benefits

Eligibility CriteriaWhile the FHA Streamline Refinance is accessible, there are specific eligibility criteria that homeowners must meet:

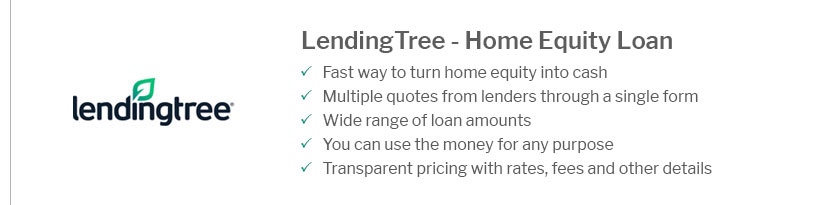

For more detailed insights on refinancing options, visit online refinance rates for comprehensive comparisons. Important ConsiderationsBefore proceeding with an FHA Streamline Refinance, it's crucial to evaluate your financial situation and long-term goals. Consider the following: Monthly Savings vs. Long-term CostsWhile lowering your monthly payment is advantageous, assess how the new loan term might extend your mortgage, potentially increasing the total interest paid over the life of the loan. Mortgage Insurance PremiumsFHA loans require mortgage insurance premiums (MIP). Evaluate how these premiums will affect your savings. FAQ SectionWhat is the primary advantage of an FHA Streamline Refinance?The primary advantage is the ability to refinance with less documentation and potentially lower monthly payments without the need for a new appraisal. Can I refinance if my home value has decreased?Yes, the FHA Streamline Refinance does not require a home appraisal, allowing you to refinance regardless of changes in your home’s market value. Is it possible to include closing costs in the new loan?Closing costs typically cannot be included in the loan balance. However, you may qualify for a lender credit that covers these costs. For those considering other refinancing avenues, exploring personal loan refinance rates might provide alternative solutions tailored to different financial needs. https://www.cornerstonemtggroup.com/new-jersey-fha-streamline-refinance

FHA streamline refinance allows you to quickly reduce the interest rate on your current New Jersey FHA home loan generally without the need for an appraisal. https://admortgage.com/programs/fha-streamline/

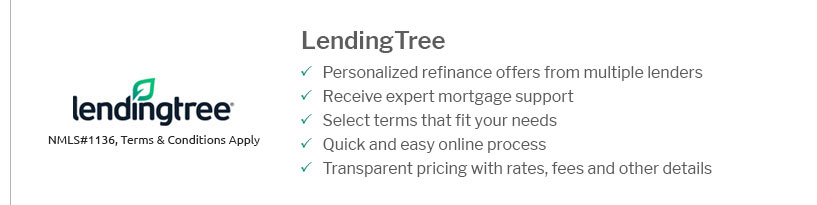

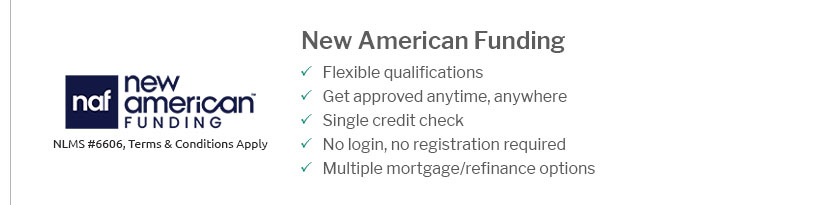

The FHA Streamline Refinance program is designed to help borrowers who have a current FHA-insured loan. It's an easy way to potentially lower interest rates ... https://www.newamericanfunding.com/loan-types/fha-loan/state/new-jersey/

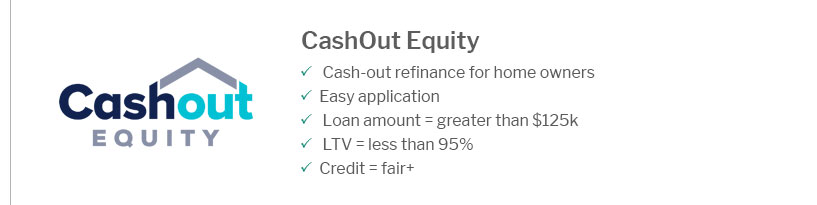

To qualify for an FHA loan in New Jersey you must meet the above requirements. You must have a credit score of at least 500. Your DTI must be less than 57%.

|

|---|